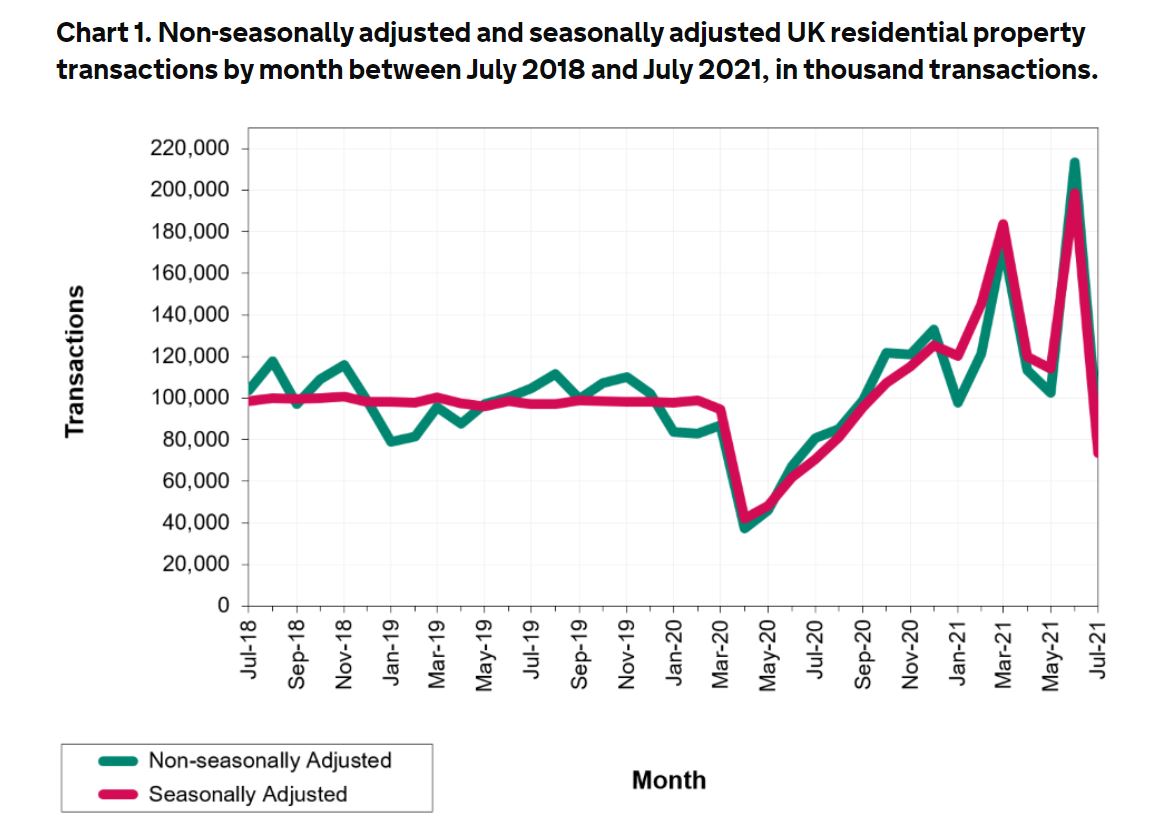

With an inevitability that was foreseen by the majority of those at the coalface of property sales from the moment that Rish Sunak announced the government’s intention to boost the pandemic property market with a stamp duty holiday, the quantity of transactions that took place in July fell off the edge of a cliff.

The provisional seasonally adjusted estimate, by HMRC, of UK residential transactions in July 2021 is 73,740, 62.8% lower than June 2021.

Reactions to the news –

Anthony Codling, CEO of Twindig:

“Housing transactions fall 63% in July 2021 as we pass the first of two stamp duty holiday cliffs. This will lead to many asking if the housing market recovery was built on sand (or a lack of stamp duty) rather than a firmer foundation.

“However, empirically housing transactions always fall after a significant change in stamp duty as many buyers have pulled forward their purchase decisions to take advantage of the stamp duty benefit whilst it lasts.

“It is also worth remembering that many can still benefit from the Stamp Duty Holiday as the stamp duty threshold still remains at £250,000 (in line with average house prices) until 30 September, before returning to its pre-pandemic level of £125,000.

“Perhaps the July cliff edge points to those wealthier home buyers being fleet of foot, suggesting this has been a holiday for the cash-rich and those higher up the housing ladder rather than those aspiring to get a foot on the ladder.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“What goes up, must come down is certainly the story being told in this data.

“Take the figures with a pinch of salt as we saw monumental growth in the volume of properties sold prior to July, in light of the rush to beat the deadline for the full stamp duty discount. It was always inevitable that July would show a dramatic downturn, although a 62.8% decrease in transactions is a big fall.

Sam Mitchell, CEO of online estate agent Strike:

“People may be questioning how the property market will cope now that the stamp duty holiday is winding down, but demand is still far greater than prior to the pandemic. Smaller properties below the £250,000 stamp duty holiday limit are partly driving this, and there’s also the ongoing trend of homeowners looking for more space and opting for regional locations over city commuter belts.

“And let’s not forget that other incentives are still at play to make it easier for people to access the market, like the increased availability of 95% mortgages and the seemingly never-ending low interest rates.”

Adam Oldfield, head of sales and account management at Phoebus Software:

“…the fact that lenders are offering record low mortgage rates is enough, it appears, to ensure appetite in the housing market remains on a par with that in 2020. While these rates are available it is likely to provide enough impetus to keep the market growing, even if it is at a reduced rate.

“Rising inflation remains a spectre on the horizon, one that we can’t afford to take our eye from. If inflation rises as the government expects I suspect we may see the Bank of England increasing the base rate, and with it mortgage rates will rise. As furlough comes to an end next month we will get a fuller picture of employment and, unfortunately, unemployment. The financial impact will then all too be evident.

“The term ‘make hay while the sun shines’ is undoubtedly apt for those looking to move or remortgage in the near future.”

Andy Sommerville, Director at Search Acumen:

“The phasing out of tax incentives might bring transaction numbers down from their record highs for a short period, but the market will continue to be fuelled by buyers who need to adapt to lasting societal changes in the post-pandemic world. It is therefore likely transaction numbers will rise again in the autumn when people are back from holiday and have had a few months to assess what their working and living arrangements might look like long term.

The number of transactions stated by HMRC is of course completions which doesn’t tell the whole story of the market. Many transactions went through more quickly and solicitors/conveyancers were motivated by their clients’s needs. More importantly, is there still an imbalance between supply and demand? We are experiencing low supply in August which is probably a combination of staycations, school holidays and the end of the stamp duty. Demand remains high and good new instructions are still selling very quickly. I think we need to get through the next few months which I’m sure will be steady but patchy and see how the market finds it’s level next year. The fuel for any housing market is how many unencumbered buyers are entering it. That fuel is now largely down to first time buyers starting the chains off and we need the banks to be granting mortgages with 5% deposits at reasonable rates. The lower end of the market has seen the lowest price increases over the last 18 months so it’s a good time for FTB’s to buy. Prices will level in the rest of the market while lower end properties catch up and we should see a nice steady market next year overall. The Brexit years caused a lot of pent up supply and demand which was released by the election and end of Brexit then accelerated by SD holiday. This bubble was a reverse effect of that so shouldn’t affect the future as much as some people expect.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

1988.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Very different scenario. Prices had risen 20-30% in just 8 months. Demand went off a cliff whereas supply increased as interests rates rose. 100-120% mortgages meant many people went into serious negative equity immediately, couldn’t afford the increase in payments when rates rose and handed their keys back. Repossessions we’re rife and drove prices further down. Nothing like what we have now. It’s just maths.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Interest rates are no doubt going up in the next few years (US federal reserve predicts approx 1% in the next 18 months) to tackle inflation (RPI currently at 3.8%)

Once help to buy, 95% LTV, and stamp duty holiday ends, house prices fall a bit, and interest rates rise, even by a fraction, a lot of these young buyers who have bought a house (2 bedroom houses selling for £300,000 in my patch) are going to be negative equity, and then the spiral starts

Maybe not like 1988, more of a slow burn

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

So, transactions are back to normal levels. They have not collapsed, slumped or fallen off a cliff. Pre July was a stampede treble the usual market. It’s another ‘no s*** Sherlock’ read.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Soooo they return to about normal after an unprecedented June

Nothing to see here folks

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Not a syllable that the figure is 4.2% UP on that of July 2020. But of course that was a period adversely affected by COVID.

The average July transactions figure for the previous-to-that 8 years (2012-2019) is 95868, so this year’s figure is down 23.1% on the historic “norm”.

Considering the previous month’s ridiculousness, I’m frankly amazed it was that good.

But I suppose it gives the doom-mongers a channel for their woes…

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

They will plummet until the new year now.

Meanwhile, time for conveyancers to take stock and tackle admin and also start marketing to preserve the same size slice of a much smaller cake.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“They will plummet until the new year now.”

Really?

According to Rightmove there are some 475,000 properties currently “Under Offer, Sold STC” – all of which will no doubt be expecting to be moved before the end of 2021. Even if you take the supposed ‘official’ fall-through rate of 30%, that leaves some 332,500 probable completions. Add to that pretty much anything and everything put in the pipeline between now and 2nd week in October (many of those being resales on the fall-throughs that may or may not happen) – I would suggest a pretty safe bet would be for another 450,000 properties to change hands in the last five months of this extremely testing year.

I would suggest if you think you’ve got time “to take stock and tackle admin” your slice of the cake will shrink – but not for the reasons you say.

Good luck with that marketing.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I never return to a post, but I will for you – and will remind you as the months pass. Deals will dry up, sorry, and what is left won’t just come to you, you have to go get that slice.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The property market is not – never has, and never will be – a straight-line graph. The second half of the year is generally less active than the first. But as to your assertion that “They will plummet until the new year now.” I would suggest that should prepare now…

…to eat your words.

“what is left won’t just come to you, you have to go get that slice.”

Funny, that – most conveyancers I know get all the work they can cope with just by doing a good job.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register