Records of the unenviable kind have fallen for the second time in consecutive quarters post the introduction of the Cost of Living (Tenant Protection) (Scotland) Act.

Records of the unenviable kind have fallen for the second time in consecutive quarters post the introduction of the Cost of Living (Tenant Protection) (Scotland) Act.

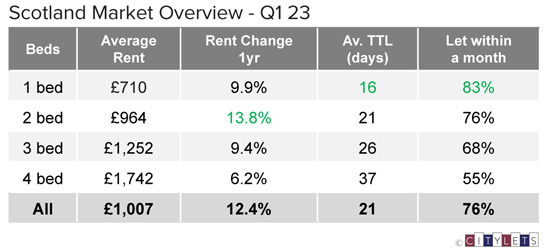

According to Citylets, the average property to rent in Scotland passed the £1,000 mark for the first time in Q1 2023 and the annual rate of growth has continued to climb Year-on-Year (YOY).

Average rents in Scotland rose 12.4% YOY to average £1,007 per month with properties taking just 21 days to let. Keen competition for property to rent around the country persists evidenced by widespread double digit growth in rents and low time to lets.

Legitimate questions of unintended consequences will increasingly come to the fore from the measures which aimed at a part of the market for which there is little to no information to quantify and qualify the scale of the problems it sought to address. Whilst matters for tenants within existing tenancies have improved with assured price stability, however arguably at the expense of those seeking new properties who continue to experience considerable price appreciation and availability challenges.

Commenting on the Scottish Market, Karen Turner of Rettie & Co. said: “The rental market remains strong in Scotland. In the main, most properties are receiving high demand for viewings with several notes of interest coming off the back of the viewing. There is strong demand for student HMO properties but we are seeing limited notices coming from students, which would have been the norm at this time of year pre-Covid. The demand from renters is there but there is still not enough stock to satisfy the demand. We need to see positive action from government to encourage both landlords and corporate investors to enter the market and aid the housing supply to help increase the stock across all tenures.”

Many agents report “a very frenetic and difficult experience for would-be tenants” at the coalface. Fears of a vicious circle of low supply and rising open market rents persist with a rent cap for existing tenancies de-incentivising moves within the PRS and constraining available supply further at a time when many plans for homeownership have also been postponed in the hope mortgage interest rates will slowly return to longer term norms of recent decades.

Gillian Semmler, PR manager at Citylets, noted: “There is little dubiety as to the outlook for 2023; continued imbalance between supply and demand. The introduction of new stringent short term lets legislation may introduce additional capacity in some urban areas such as Edinburgh where councils will seek to use their new powers to aggressively reduce holiday let volumes, refusing licenses to operate leaving owners to consider other options such as residential letting.”

Citylets MD, Thomas Ashdown, expressed concern as to the direction of travel: “It is imperative that the root cause of recent price appreciation in the open market is properly understood. Until such time as there are clear viable alternatives, the PRS continues to play a key role in Scotland’s housing mix and should be supported as such ensuring the right balance between tenants and landlords both in terms of policy and in terms of available properties to rent. We seem to be heading in the wrong direction at present and continue to hope for positive change. More houses of all kind are needed.”

Less supply, more demand-increased price, funny that.

Cap the price and they become even more rarer or non existent.

Landlords are not going to graft/risk for free, 3.89% interest achievable on 1yr bond or average 20% over last 20 years with Mr Buffet ! and no midnight phone calls !

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Understatement of the year award goes to ……

“a very frenetic and difficult experience for would-be tenants”

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register