A growing number of brothers and sisters are helping each other to buy their first homes, new research shows.

A growing number of brothers and sisters are helping each other to buy their first homes, new research shows.

Almost a third – 32% – of people in Britain who purchased their first home this year had financial help from family, with support from siblings double that of six years ago.

Brothers and sisters helped a record 11% of family-funded first-time acquisitions, according to research from Hamptons estate agency and Skipton Building Society.

Who contributes towards a first-time buyers’ deposit (Great Britain):

| Share of contributions by family member 2023 | 6-year change | Median contribution | |

| Parent | 72% | -8% | £15,250 |

| Sibling | 11% | 6% | £10,250 |

| Grandparent | 8% | -2% | £10,000 |

| Aunt/Uncle | 4% | 1% | £15,000 |

| Other – Family | 3% | 3% | £14,000 |

| Son/Daughter | 1% | 0% | £15,750 |

Source: Skipton Building Society & Hamptons

Parents remain most likely to gift money towards a child’s deposit, making up 72% of those lending support so far this year. However, this share has gradually declined from a peak of 80% in 2018 as first-time buyers increasingly look to other family members for help. Parents are also the most generous, gifting an average of £15,250 so far in 2023.

After parents and siblings, grandparents were next likely to lend their support and made up 8% of family members putting money towards a deposit this year, slightly down from 9% in 2017 when Skipton’s records began. They gifted an average of £10,000 so far this year.

Overall, these family contributions made up an average of 63% of a first-time buyer’s total deposit. This additional help means that first-time buyers are able to put down bigger deposits than those who have saved entirely themselves.

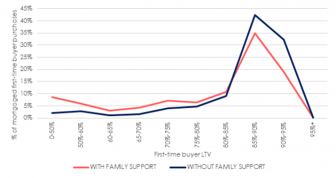

More than a third – 35% – of first-time buyers with family support were able to put down a +20% deposit on their home this year, nearly double the proportion (16%) of first-time buyers who didn’t receive financial help from their families.

Distribution of first-time buyer loan-to-value (LTV) mortgages so far this year:

Source: Skipton Building Society & Hamptons

Family help tends to mean first-time buyers purchase a more expensive home. The average first-time buyer in Great Britain who had family help paid £257,290 for their home this year, £6,500 more than someone without additional contributions. It also allowed them to buy sooner. The average first-time buyer who had a deposit boost from a family member was 31.3 years of age compared to 32.5 years for someone who saved up themselves.

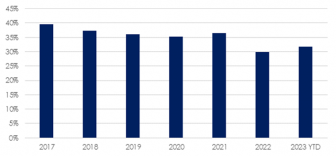

Higher interest rates have reversed the declining trend in family members gifting money for a deposit. Overall, nearly a third (32%) of all first-time buyers in Great Britain received a financial gift towards their deposit this year, slightly up from 30% in 2022. However, this figure remains lower than when Skipton’s records began, when 40% of those who bought their first home in 2017 were gifted money (chart 2).

Share of first-time buyers receiving a family gift towards their deposit (GB):

Source: Skipton Building Society & Hamptons

First-time buyers purchasing in Yorkshire & The Humber are most likely to have additional support. Some 40% of households who purchased their first home here this year received some form of family funding, up from 31% in 2022. These first-time buyers were gifted an average of £9,770, the second smallest contribution in Great Britain. Given that homes here are more affordable than average, family members are more likely to be able to contribute towards what’s likely to be a smaller deposit in cash terms.

Meanwhile, 27% of first-time buyers in Scotland had family help, the lowest proportion in Great Britain.

In cash terms, first-time buyers in London received the biggest financial boost from family. On average, they were gifted £34,270 so far this year which is more than double the national average (£14,220) (table 2).

Share of first-time buyers receiving a deposit contribution from family:

| % of first-time buyers who received a family gift (2023) | YoY Change | Average family gift | |

| Yorkshire & The Humber | 40% | 9% | £9,770 |

| South West | 39% | 5% | £16,280 |

| North East | 33% | 6% | £13,700 |

| East of England | 32% | 2% | £13,950 |

| East Midlands | 32% | 3% | £10,430 |

| Wales | 31% | 5% | £9,700 |

| South East | 31% | 1% | £19,470 |

| Greater London | 30% | 0% | £34,270 |

| West Midlands | 30% | -1% | £13,670 |

| North West | 29% | -3% | £12,700 |

| Scotland | 27% | 1% | £18,550 |

| Great Britain | 32% | 2% | £14,220 |

Source: Skipton Building Society & Hamptons

Aneisha Beveridge, head of research at Hamptons, said: “Children are much more likely to become homeowners if their parents already own a home. But is the bank of Mum and Dad running dry? As homeownership rates decline through the generations, younger parents today are less likely to be homeowners than their predecessors, which reduces their ability to withdraw equity from their home to pass on to children.

“Rather, first-time buyers are increasingly leaning towards other family members to boost their deposits. Siblings are at the forefront with older brothers and sisters at the more affluent end of the spectrum putting their hands in their pockets. They are highly likely to already be homeowners who want to help their younger siblings take their first step onto the property ladder.

“Should interest rates stay higher for longer, it will exacerbate the gap between what those with and without family help can afford. Those without help will likely face saving up for longer and buying later in life or purchasing a smaller home in a more affordable area to keep their mortgage payments within their means.”

Charlotte Harrison, interim CEO of Home Financing at Skipton Building Society, added: “The research highlights just how much financial support is needed for first-time buyers in the current climate and the lengths that not just the Bank of Mum and Dad, but their wider families are now having to go to, to help their loved ones take a step up onto the property ladder.

“With high property prices, escalating rents and the cost-of-living squeeze further impacting people’s ability to save for a house deposit – it’s making it almost impossible for people to get onto the property ladder without a boost to their savings. For many, despite potentially being able to pass a typical mortgage affordability check – it’s the lack of a deposit that’s holding them back from their home ownership aspirations.

“Support from the ‘family bank’ in this way is a real boost to first-time buyers’ purchasing power, giving them a head start onto the property ladder much earlier than what they’d have achieved on their own. However, we know not everyone is lucky enough to have access to family wealth in this way, which is why other alternative routes to homeownership without the need for family wealth are so critical.”

Support from the ‘Bank of Family’ to help pay for 318,000 homes

Comments are closed.