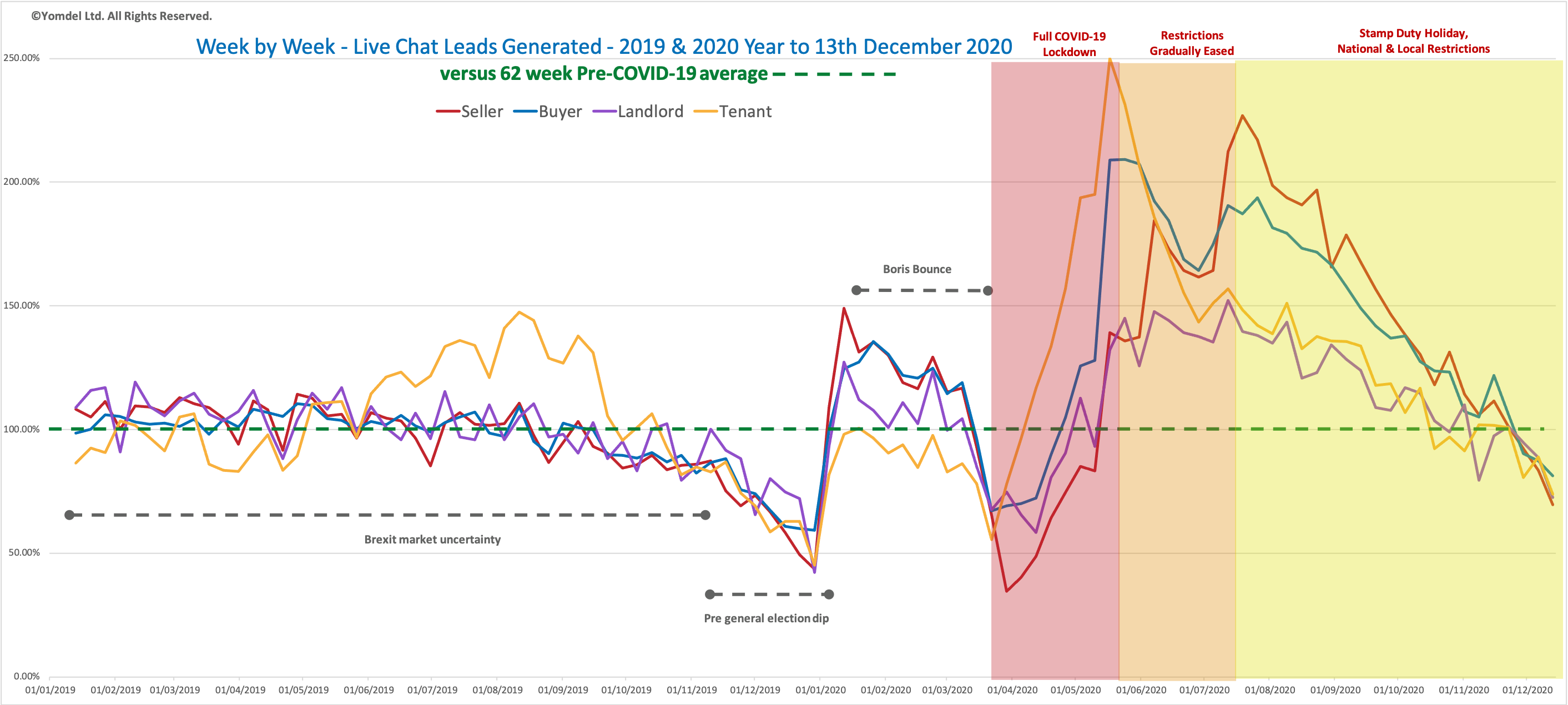

Plunging enquiries from landlords and tenants, far fewer vendors and sliding interest from buyers took new enquiries to estate agents to their lowest levels since the depth of lockdown in March and April, the latest Yomdel Property Sentiment Tracker (YPST) showed.

A Christmas seasonal slowdown is normal for this time of year, but while vendors remained a healthy 19% higher and buyers 34% higher, respectively, than the same week last year, landlords dived into negative territory to finish the week 3% down on the same week 2019. All key indicators for vendors, buyers, landlords and tenants are now at at their lowest levels since early in the coronavirus crisis.

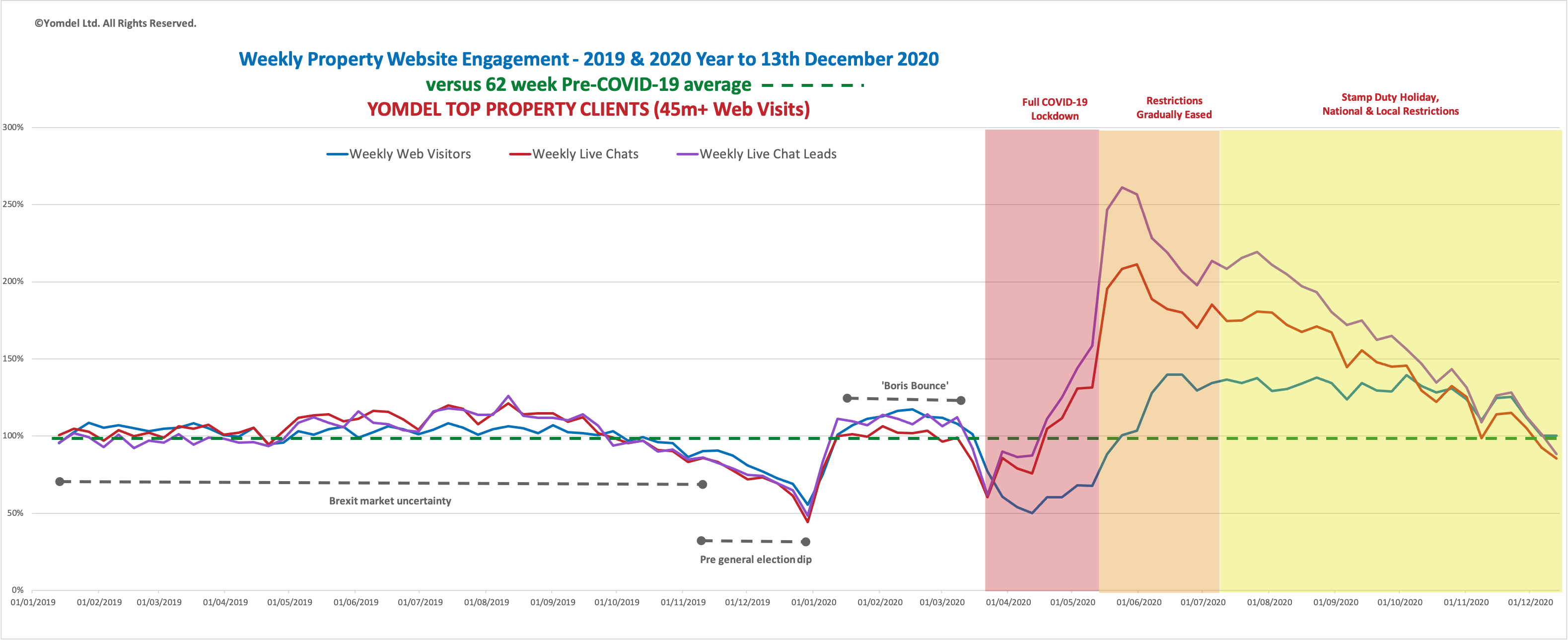

But estate agents still have unseasonably high levels of digital engagement from the general public with visits to own-branded websites some 37% higher than the same week last year, generating 23% more live chat engagements and 38% more leads to further illustrate the huge shift in consumer behaviour and online channels seen through 2020.

Yomdel provides 24/7 managed live chat services to 3,800 estate agent offices in the UK, handling more than a 1.5m chats per year. It has analysed the data and leads captured in live chat going back to January 2019, up until week ending 13 December 2020. The website visitor data is a sample across major estate agency groups in the UK and covers in excess of 45 million unique website visits back to January 2019.

“As you’d expect, with Christmas upon us new enquiries are reducing and the key question is what is going to happen in January. Will we see the usual new year boost, or have the huge volumes this year not just tapped pent up demand but also sucked up future demand from the market?” said Andy Soloman, Yomdel Founder & CEO.

“The overall economic outlook due to Covid and Brexit remains gloomy and while things such at the stamp duty holiday has helped estate agents prosper in the short term, the outlook remains extremely uncertain. One thing which is clear is that consumers have flocked to digital channels and online in greater numbers than ever before,” he added.

The YPST methodology establishes a base line average shown as 100% or 100, calculated according to average engagement values over the 62 weeks prior to the lockdown, and plots movements from there according to the volumes of people engaging in live chat, their stated needs, questions asked, and new business leads generated. Data is measured over full 24-hour periods.

New vendors lost 16.53%, or 13.80 points, to end the week on 69.69, which left them 30% below the pre-covid-19 62-week average, but 19% above the same week in 2019.

Buyers dropped 6.89%, or 6.02 points, to close at 81.34, some 19% below the pre-covid-19 average but 34% above the same week last year.

Landlords slumped 18.30%, or 16.25 points, to finish at 72.55, some 27% below the average but and 3% below the same week in 2019.

Tenants followed suit, falling 17.06%, or 15.19 points, to close at 73.83, some 26% below the pre-covid-19 average and 17% higher than the same week last year.

The following graph looks at the relationship between website visitor volumes, live chat volumes and the volume of leads generated. The data samples more than 45 million visitors to estate agent websites from Jan 2019 – 13 December and shows how web traffic (blue line) is 37% higher than the same week last year. The volume of people using live chat (red line) and the numbers of new business leads captured (purple line) are 23% and 38%, respectively, above the same week 2019.

Comments are closed.